UnitedCrowd Tokenization

UnitedCrowd

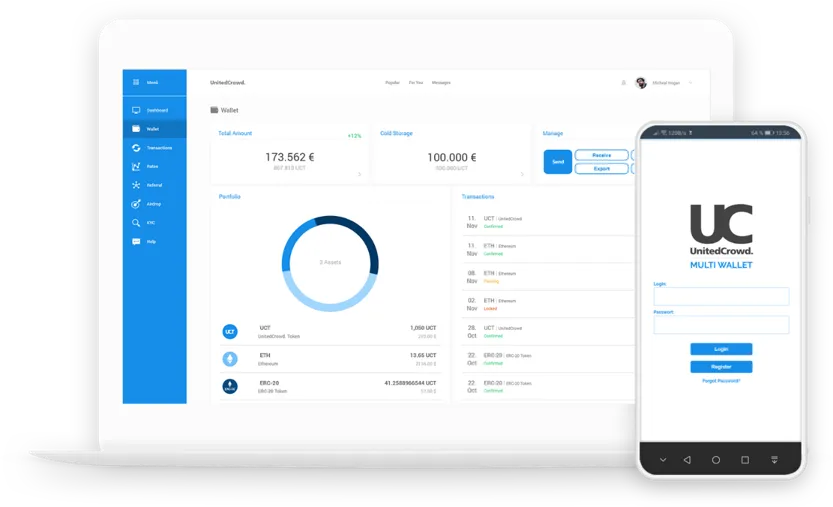

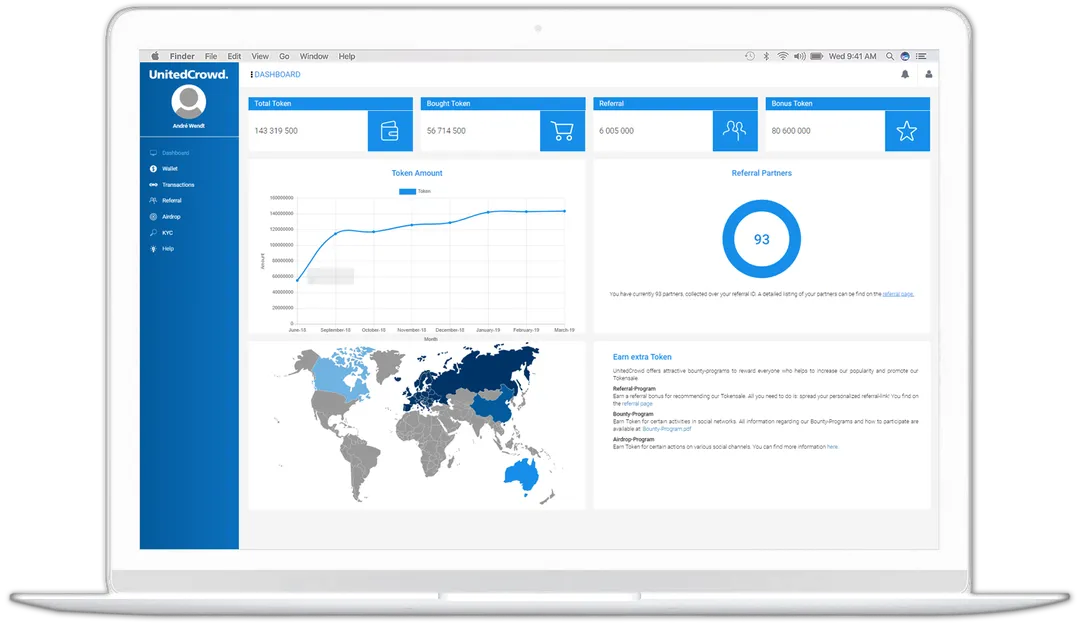

UnitedCrowd is a platform for digital financial instruments. With our Tokenization Framework we can issue digital financial products – for the purpose of corporate finance for instance. The framework makes it possible to model financial products based on blockchain technology and to automate them via intelligent, template-based contract models, so-called smart contracts which are then mapped as tokens. In close cooperation with regulatory authorities, all contracts are validated for compliance with country-specific regulations. In order for a token to fulfil its intended purpose and to bring all stakeholders together, various processes must interlock dynamically and grant different instances with their own access rights.

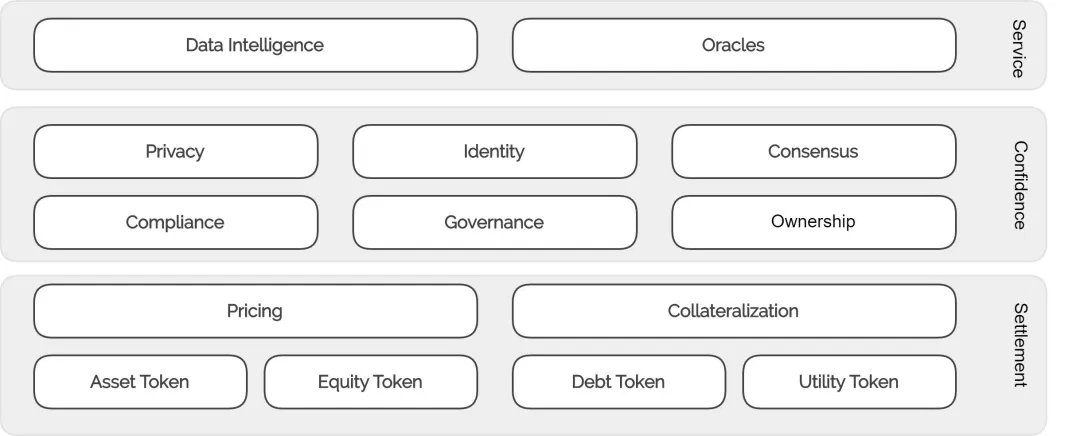

Architecture

The 3-layer model on which the framework is based separates the subtasks of the network and the accessibility of rights holders on different instances. Access is granted to all role holders restrictively according to the exercise function, both via API and via the front end, and regulators via direct access.

Layers and components

● Settlement layer

The settlement layer includes all on-chain elements of the framework. There, assets are automated via smart contracts and initialized as tokens. Different financial instruments each have their own requirements for the token and are differentiated into different token classes depending on the product. The settlement layer also forms the basis of the price calculation based on statistical price models that take into account risk, dividend payment, market conditions and other elements that are unique to each token. In addition, risk reduction mechanisms are provided via hedging protocols, which are necessary for various models against the default risk.

● Confidence layer

The confidence layer organizes compliance and data validation and defines structures and processes to ensure that legally binding and ethical rules can be included. Validating compliance with legal and financial regulations is the central requirement, which aims to provide both flexible responsiveness and the protection of right holders. Consistent identity protocols for the collection of personal data of issuers, investors and companies are essential and prescribed by law. Securing the ownership of tokens and their possible transfer, as well as adapting new legal regulations is possible both in a centralized form by the issuer and in the form of “distributed governance” by the stakeholders. Consensus protocols are the key to the allocation of rights, the transfer of which is made possible by authorization mechanisms and which enables the coordination and control dynamics and the representative transfer of rights created by voting.

● Service layer

The service layer provides interfaces for off-chain communication. The data exchange takes place via Oracle and DAPPs, which ensure communication via the frontend and by communicative functions, distribute either reading rights only or control functions for different role holders. As a key component for the provision of off-chain values, a solid “data intelligence layer” provides an interface for analysis and information. In addition to KYC / AML regulations, different off-chain data or compliance models can be provided for different assets.

Access by instances

Different requirements are mapped within the framework using different components and organized in layers.

1. Issuing

The initiation of contracts and the associated token issuance is the sole responsibility of the issuer and the administrator responsible for the technical implementation of the issue appointed by him. The access authorization of the output is given via the settlement layer both via the API access and via the frontend. The regulations and issue conditions (compliance and validation) are monitored for the issuer and his administration via the frontend, as is the data accumulation via the service layer.

2. Investing

The investing entity declares its contract ownership and the associated token emission via the frontend at the contract level. The compliance and validation rules on which the contract is based can be viewed via the front end, as can contract and history data via the service layer.

3. Custody

Access to the settlement layer is required to ensure transaction ability of custody. Compliance with the high security standards and regulatory compliance on the part of the regulatory authorities can be achieved by accessing the confidence layer. Access takes place both via the API and via the frontend.

4. Exchange

External exchange providers require access to the settlement layer for transaction purposes. In order to meet the market requirements for real-time transactions, access is made possible via API interfaces. Access to external exchanges is mandatory and, like the tracking of historical data, is solved for the purposes of data accumulation and statistics via API interfaces.

5. Delegation

Delegating refers to the partial and additional relinquishment of governance by contracting parties to adjust the conformity with the rules. The committee designated for delegation is democratically elected via the smart contract level, has a control function transmitted through the network and, in its function, read access to the settlement layer and access to the confidence layer.

6. Regulators

Regulators access takes place in the form of direct access to the “Real World Contracts”, which is essential due to the regulatory approval requirement.

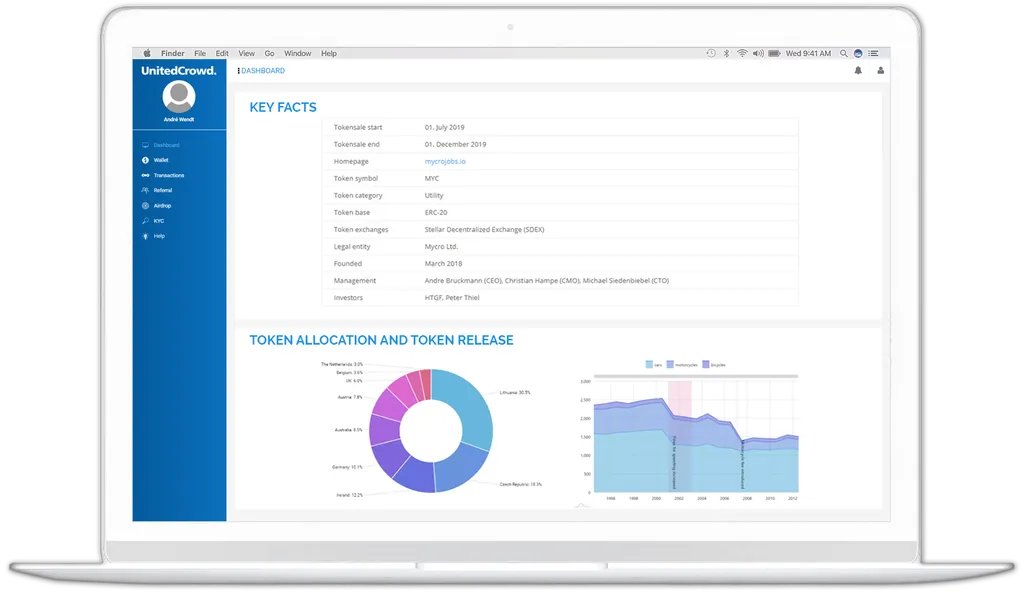

Issuance of token

Compliance with the legal framework and regulatory mechanisms are guaranteed both off-chain and on-chain.

1. Review of the issuer

Before UnitedCrowd creates a digital financial product, we check the issuer against fixed parameters that are queried and evaluated. These include, for example, due diligence, governance and security of the company, but also the management, which, among other things, goes through a standard check and a background check on the integrity and reputation risk.

2. Choice of financing type

If the requirements are met and we are convinced of the sustainability of the project, the decision on the type of financing follows in a second step. With the Tokenization Framework, different values can be digitized with all rights and obligations contained in them. Depending on the requirements and goals of a company, those variants have differing suitability.

Thereby the following classifications are relevant:

● Asset Token (financial assets)

Both liquid and illiquid assets can be represented as tokenized securities by Asset Token. In this way, they can be converted into digital and proportionate fractional ownership (partnership) and made accessible to an international market. The spectrum encompasses everything from cash, cash equivalents, savings accounts, real estate, precious metals or art objects to intangible assets such as patents, copyrights or trademark rights.

● Equity token (shares)

Equity tokens can represent shares in a company and voting rights, as well as shares in funds.

● Debt Token (claiming rights)

Tokens represent a debt claim for repayment of the invested amount with or without interest. The range includes forms of bonds, loans and bonds.

● Utility token (services and usage rights)

Utility tokens represent usage rights and can be used, for example, to grant access to a network as a community token or to receive the goods or services offered by the issuer of the token.

What are the advantages of tokenization with UnitedCrowd?

Tokenization has several advantages, which we will display below:

- 24/7 markets

- Fractional ownership

- Compliance

- Reduction of costs and intermediaries

- Peer-to-peer transmission

- Fast processing

- Programmability

- New financial products

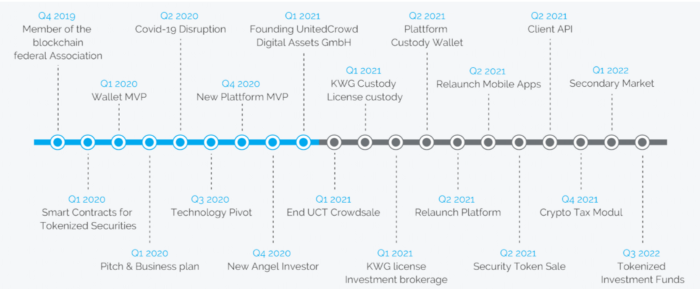

Roadmap

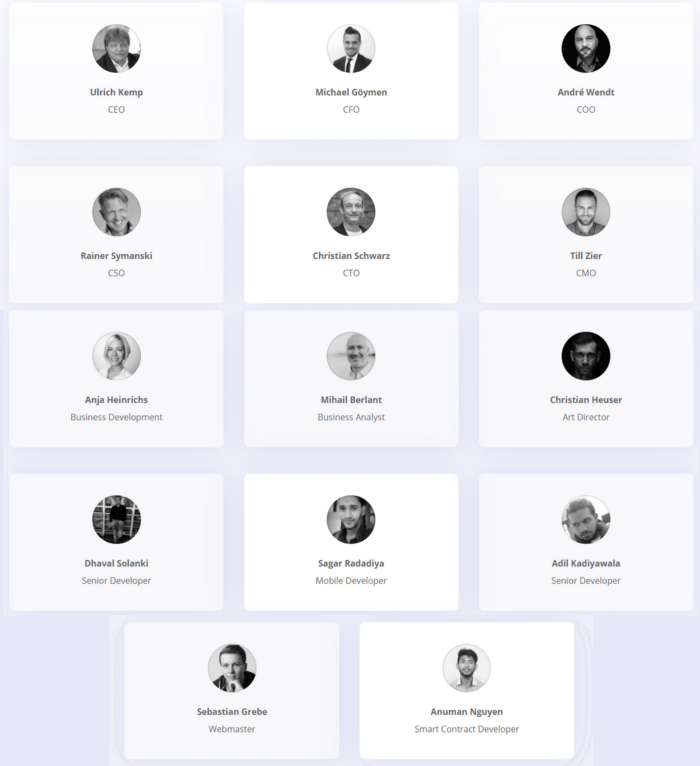

Team.

UnitedCrowd project partner

More information:

● Website : https://unitedcrowd.com/

● Facebook: https://www.facebook.com/UnitedCrowd/

● Twitter: https://twitter.com/unitedcrowd_com

● Telegram: https://t.me/UnitedCrowd

● Linkedin: https://www.linkedin.com/company/unitedcrowd/

● Instagram: https://www.instagram.com/unitedcrowd_com/

● Youtube: https://www.youtube.com/c/UnitedCrowd

author : bondan88 profile : https://bitcointalk.org/index.php?action=profile;u=2632383 eth : 0x0D7fBAd549E0dd2BD7242A8060BB2441CF1f5A3A

Komentar

Posting Komentar